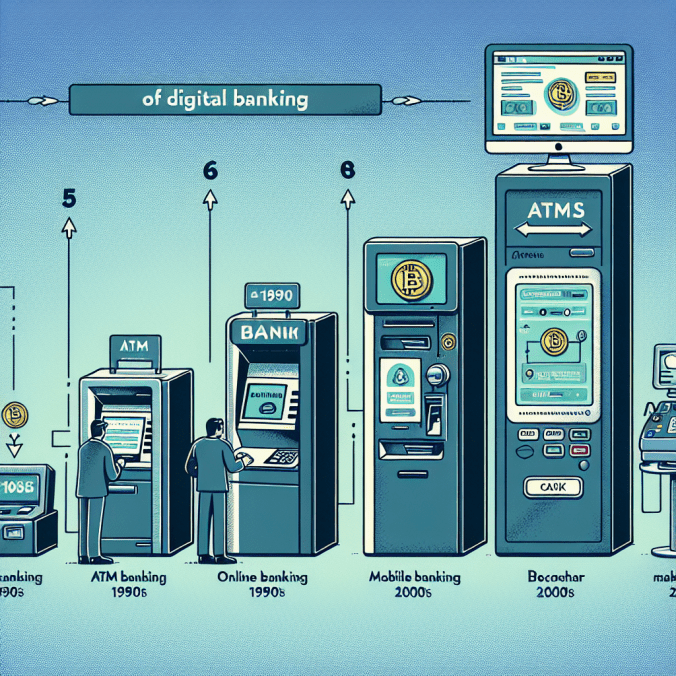

The Evolution of Digital Banking: From ATMs to Crypto

Once upon a time, banking involved marathon sessions at a branch with paperwork that could rival the thickness of a sci-fi novel series. But those days are gone! Today, digital banking is at your fingertips, sometimes quite literally, through your mobile app. From the humble ATM to the sophisticated world of cryptocurrency, let’s take a fascinating stroll through the evolution of digital banking.

The ATM: The Original Tech Wizard

Let’s start our journey with a technology that we now take for granted but was revolutionary in its time—the Automatic Teller Machine (ATM). Introduced in the late 1960s, ATMs were the first step towards digital banking. These were designed to unchain customers from strict bank hours, providing 24/7 access to their money.

- First ATM: Installed in 1967 in London.

- Initial Services: Cash withdrawal and balance inquiry.

- Pioneering Banks: Barclays was among the pioneers.

ATMs hinted at a future where banks would increasingly leverage technology to enhance customer convenience. Little did we know, this was just the beginning!

Internet Banking: Making Mouse Clicks Count

Fast forwarding to the 1990s, the internet erupted onto the scene and brought with it the next significant wave—online banking. Internet banking meant that your local bank was no longer your only account-opening option. Suddenly, transactions didn’t need you to move beyond your couch comfort zone.

Some of the notable features introduced with internet banking included:

- Fund transfers and bill payments from home.

- Account management via digital platforms.

- Access to statements and loan applications online.

This was a banking revolution! Proving to be more convenient than queuing up on Friday afternoons, online banking opened up the services portal worldwide.

Mobile Banking: The App-solute Advantage

If internet banking allowed us to use computers to manage our money, mobile banking stated: Why carry a PC when your smartphone is already in your pocket? With unmatched convenience, mobile banking integrates banking tasks with our everyday device.

Applications brought responsive features customized for on-the-go access:

- Real-time transaction notifications and alerts.

- Remote check deposits via phone camera.

- Seamless integration with personal finance apps.

Mobile banking apps have strengthened user authentication and security extensively, ensuring that our financial transactions are as safe as trading snacks with a watchful parent around!

Crypto and Decentralized Finance: The New Frontier

The evolution of digital banking doesn’t stop at convenience. Enter the realm of cryptocurrencies and decentralized finance (DeFi)—the wild west of digital innovation. With blockchain technology, financial transactions are increasingly transparent, secure, and perhaps most excitingly, beyond traditional banking’s control.

- Bitcoin led the charge, introducing a new form of currency.

- Ethereum expanded blockchain’s potential with smart contracts.

- DeFi platforms aim to offer traditional banking services via decentralized networks.

While still evolving, crypto and DeFi platforms have enthusiasts confident enough to keep looking over the horizon, eyes twinkling like diamonds (or should we say Dogecoins?!)

The Future: Economy and Banking Updates

As digital banking continues to evolve, staying informed becomes critical. For those interested in keeping up with the latest economic news, analysis, and trends, tuning into resources like the Financial Content on Telegram Channels can be incredibly valuable. Discover economic insights and stay ahead in the digital banking landscape.

Ultimately, digital banking’s evolution showcases our unfaltering quest for efficiency and convenience. Whether it’s withdrawing cash at an ATM or investing in cryptocurrency, the world of finance is both a marathon and a sprint, but one we can now all run better, with technology guiding our every step.