The Evolution of ATMs: From Cash Dispensers to Multi-Functional Banking Hubs

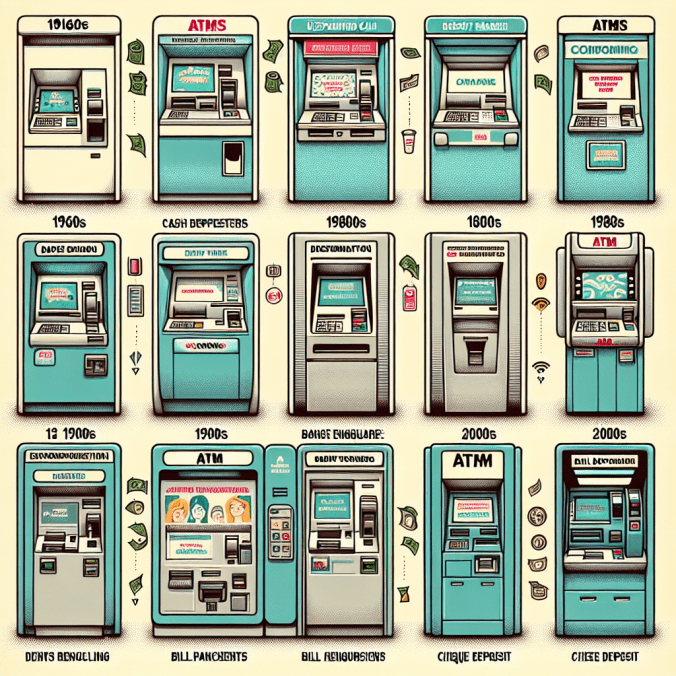

In an era where digital banking and online transactions dominate, Automated Teller Machines (ATMs) have deftly evolved to stay relevant. What once began as a simple cash dispenser has transformed into a sophisticated multi-functional banking hub. This evolution reflects technological advancements, customer preferences, and the banking industry’s drive to offer comprehensive services. Let’s journey through the incredible transformation of ATMs from their inception to today’s tech marvels.

The Birth of ATMs: A Revolutionary Cash Dispenser

The story of ATMs dates back to the 1960s. When the first ATM was unveiled by Barclays Bank in London on June 27, 1967, it caused quite a stir. This machine was the brainchild of John Shepherd-Barron, who envisioned a self-service banking solution that could dispense cash to customers at any time of day.

Back then, ATMs were rudimentary devices. Customers used special tokens instead of the magnetic stripe cards we are familiar with today. The functionality was limited to simple cash withdrawals. However, this innovation marked the beginning of a new era in banking, paving the way for greater accessibility and convenience.

The 1980s and 1990s: Expanding Functionalities

As we stepped into the 1980s and 1990s, ATMs began to mature. The introduction of magnetic stripe cards allowed for more secure and efficient transactions. These decades witnessed significant enhancements in ATM capabilities, including:

Balance Inquiries: Customers could now check their account balances on the go.

Deposits: ATMs started accepting cash and check deposits, reducing the need for in-branch visits.

Interbank Transactions: Network connectivity enabled customers to withdraw money from ATMs not owned by their bank, enhancing usability.

ATMs were quickly becoming indispensable tools for everyday banking needs.

The 2000s: Technological Advancements

The turn of the millennium ushered in a wave of technological innovations that revolutionized ATMs. The early 2000s saw the integration of advanced security features such as PIN authentication, encryption, and anti-skimming technologies, making ATMs safer and more reliable.

Additionally, touch-screen interfaces replaced traditional buttons, enhancing user experience and making transactions more intuitive. This period also witnessed the introduction of biometric authentication, adding another layer of security. Customers could now perform a wide array of banking tasks at ATMs, including:

Transferring funds between accounts

Paying utility bills

Purchasing mobile credits

The 2010s and Beyond: The Rise of the Multi-Functional Banking Hub

In the last decade, ATMs have truly come of age, evolving into multi-functional banking hubs. Modern ATMs offer an impressive array of services, transforming them into comprehensive self-service banking stations. Here are some of the latest features:

Video Banking: Customers can connect with bank representatives via video calls for personalized assistance.

Cardless Transactions: With mobile apps and QR codes, customers can withdraw money without a physical card.

Loan Applications: Some ATMs even allow users to apply for loans and credit cards directly from the machine.

Multi-Currency Support: Travelers can withdraw foreign currency from select ATMs, making international travel more convenient.

Cryptocurrency Transactions: With the rise of digital currencies, a few ATMs now support cryptocurrency transactions.

The Future of ATMs: What’s Next?

As technology continues to advance, the possibilities for ATMs are endless. We can expect even more integrated services, enhanced security measures, and increased interactivity. For instance, artificial intelligence could soon enable ATMs to offer personalized financial advice, while blockchain technology may redefine transaction security.

Moreover, the rise of wearable technology and the Internet of Things (IoT) could lead to even more seamless and convenient banking experiences. Imagine initiating a transaction on your smartwatch and completing it at an ATM with a simple gesture!

Conclusion: A Legacy of Innovation

From humble beginnings as mere cash dispensers, ATMs have evolved into sophisticated multi-functional banking hubs. This transformation underscores the banking industry’s commitment to leveraging technology for improved customer service and convenience. As ATMs continue to innovate, they remain a vital part of our financial ecosystem, adapting to meet the evolving needs of customers worldwide.

To see some innovative ATMs in action, check out this YouTube video showcasing the latest advancements in ATM technology.

Stay tuned to our blog for more captivating insights into the world of banking technology!