How Artificial Intelligence is Shaping the Future of Customer Service in Banks

Artificial intelligence (AI) is the technology buzzword that’s turning heads and transforming industries. One sector experiencing a significant shake-up thanks to AI is banking, particularly in the realm of customer service. You might ask, “How exactly does AI enhance the customer experience in banks?” Buckle up and read on as we navigate through the fascinating ways AI is revolutionizing customer service in the banking industry.

1. Personalization at its Finest

Have you ever felt like banks treat you just like another number? Well, those days are fast becoming a thing of the past. With AI, banks are delivering personalized experiences like never before. From tailoring financial products to suit individual needs to sending customized offers based on spending habits, AI takes customer engagement to a new level.

It’s like having a digital relationship manager who not only remembers your name but also your favorite ice cream flavor! That’s the power of AI-driven personalization in banking.

2. 24/7 Customer Support

Remember the days when you had to queue up for hours to get your banking queries answered? Thanks to AI, those days are history. AI-powered chatbots provide customers with instant support, and they’re available around the clock. Whether you need to check your balance at 2 AM or report a lost card during the holidays, AI is always at your service.

These chatbots are more than just automated response systems; they’re getting smarter and more intuitive. Over time, they learn from interactions and provide more accurate and personalized responses. And the best part? They never ask for a coffee break!

3. Fraud Detection and Prevention

We all have that irrational fear of spotting a suspicious transaction on our bank statements. AI is here to alleviate those fears. AI systems analyze patterns and detect unusual activities in real-time, reducing the risk of fraud. They quickly flag transactions that diverge from the norm, making it easier to take corrective actions before any damage is done.

In essence, AI serves as a vigilant guardian angel for your finances, ensuring that your hard-earned money stays safe and sound.

4. Predictive Analytics for Better Decision Making

Wouldn’t it be great if your bank could predict when you might need a loan or when you’re likely to make significant withdrawals? With AI-driven predictive analytics, that’s exactly what’s happening. Banks can now use AI to analyze customer data and predict future financial behaviors. This allows them to offer timely advice, personalized products, and proactive support.

Imagine your bank notifying you about lucrative investment opportunities just before you even thought about investing. Talk about being ahead of the game!

5. Enhanced Branch Services

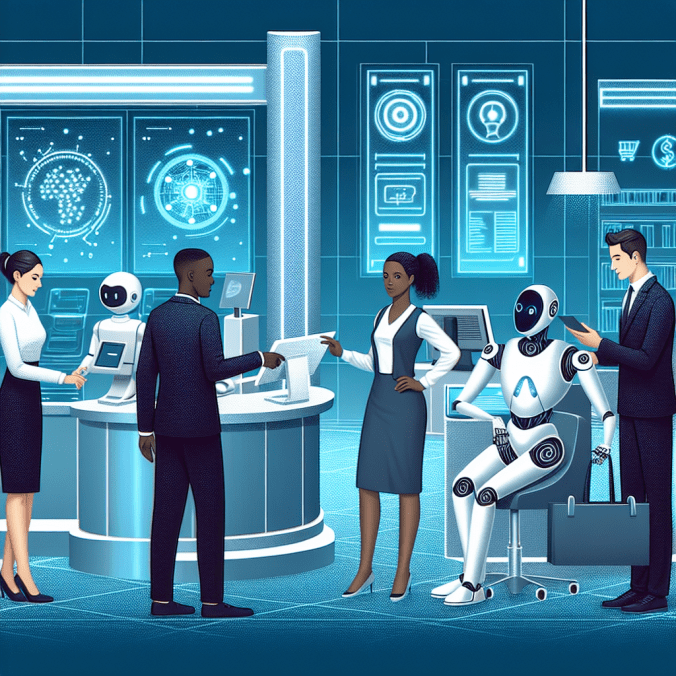

While digital banking is on the rise, physical bank branches aren’t going extinct anytime soon. AI is also enhancing the in-branch experience. Intelligent kiosks and AI-driven customer management systems reduce wait times and streamline services. Automated machines can even handle complex transactions, leaving human staff available for more personalized interactions.

This fusion of AI and human touch ensures customers receive efficient and empathetic service—a win-win for everyone involved.

Why AI Matters for the Future of Banking

The integration of AI in customer service is not just a trend; it’s the future of banking. By enhancing personalization, ensuring round-the-clock support, preventing fraud, utilizing predictive analytics, and improving in-branch experiences, AI is setting new standards for customer service in banks.

For those keen on staying updated with the latest economics and finance trends, don’t miss out on the Best Economic Analysis Telegram Channels. Here, you’ll find practical insights and updates that can help you understand how AI and other technologies are shaping the financial sector.

AI is not just helping banks serve their customers better; it’s making our financial lives more secure, personalized, and proactive. As we look ahead, it’s clear that the marriage between AI and banking will continue to evolve, promising a future where customer service is not just a function but an exceptional experience.

So the next time you converse with a bank’s chatbot, remember—it’s not just a machine. It’s a glimpse into the future of banking. And that’s something even your favorite human teller would tip their hat to!