Exploring the World of Cryptocurrencies: How Banks are Adapting to Digital Currencies

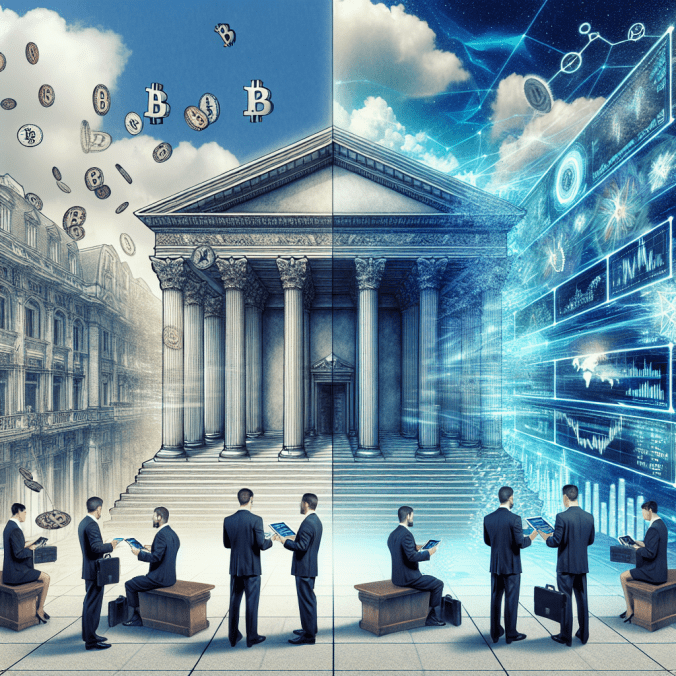

Once upon a time, bankers shuddered at the mere mention of cryptocurrencies. Fast forward to today, digital currencies are not only riding through the financial labyrinth but are actively being integrated into traditional banking systems. Curious to see how banks are evolving in this cryptocurrency era? Let’s dive in!

The Rise and Shine of Cryptocurrencies

Initially viewed as the wild, wild west of finance, cryptocurrencies have dramatically transformed over the years. Thanks to Bitcoin, Ethereum, and other digital juggernauts showing the world a decentralized form of economy, cryptocurrencies have captured the interest of everyone from teenagers in their bedrooms to suit-and-tie bankers. So, what’s driving this crypto craze?

- Decentralization: Cryptocurrencies operate independently of central banks, offering a level of financial autonomy that’s hard to resist.

- Security: With blockchain technology, transacting is safer and less susceptible to fraud.

- Global Reach: No borders, no restrictions. Digital currencies eliminate the hassle of exchanging money while traveling or doing business internationally.

Banks’ Initial Hesitation

Remember when your grandma was wary of using online banking? Similarly, banks too were initially skeptical about digital currencies. Say what you will, but the financial sector isn’t too keen on surprises. Concerns ranged from the volatility of cryptocurrencies to regulatory hurdles and potential security risks. It was as though banks were stuck between a rock and a digital ledger!

The Gradual Transformation

But as Bob Dylan famously crooned, “The times, they are a-changin’.” Here’s how banks have started to come to terms with the rise of cryptocurrencies:

Investing in Blockchain Technology

Banks have increasingly begun to see blockchain technology not as a threat but as an opportunity to revolutionize their own systems. Whether it’s for faster transaction processing, reduced operational costs, or enhanced security, blockchain is becoming the digital knight in shining armor.

Launching Their Own Digital Currencies

To retain their slice of the financial pie, several banks are now developing their own digital currencies or stablecoins. JP Morgan, for example, has introduced JPM Coin, designed for seamless, instant blockchain transactions. Talk about if you can’t beat ’em, join ’em!

Regulatory Compliance and Partnerships

Banks are also stepping up their game by collaborating with fintech companies and adapting to the evolving regulatory landscape. By doing so, they can ensure that their crypto transactions are as accountable and compliant as those handled in traditional banking systems.

What’s in it for the Banks?

Integrating cryptocurrencies isn’t just about staying relevant; it’s also about tapping into a wellspring of opportunities:

- Enhanced Customer Experience: Offering additional services such as crypto wallets or exchange platforms provides a seamless banking experience.

- Revenue Streams: Trading fees, custodial services, advisory roles—these are just some of the new revenue avenues that cryptocurrencies open up for banks.

- Innovation and Growth: Embracing digital currencies allows banks to be at the forefront of financial innovation, attracting tech-savvy customers and boosting their growth trajectory.

Challenges Along the Way

Of course, it’s not all rainbows and butterflies. Banks face several hurdles as they embrace digital currencies:

- Regulatory Uncertainty: Navigating the complex web of global regulations can be a headache for even the most astute bankers.

- Security Concerns: While blockchain is secure, cryptocurrencies are often targeted by cybercriminals. Implementing robust security measures is crucial.

- Market Volatility: The infamous volatility of cryptocurrencies remains a significant concern. Banks must find ways to mitigate these risks to offer stable services.

The Crypto-Friendly Future

So, what does the future hold? It’s clear that banks are no longer just riding the crypto wave—they are becoming an integral part of it. From integrating blockchain technology to launching their own digital currencies, the journey has just begun. Embracing this new financial frontier could very well define the next chapter in banking history.

Stay tuned, because the crypto saga is far from over, and as always, we’re here to decode it, one blockchain at a time.

Who knows, maybe someday even your grandma will know her way around a crypto wallet!