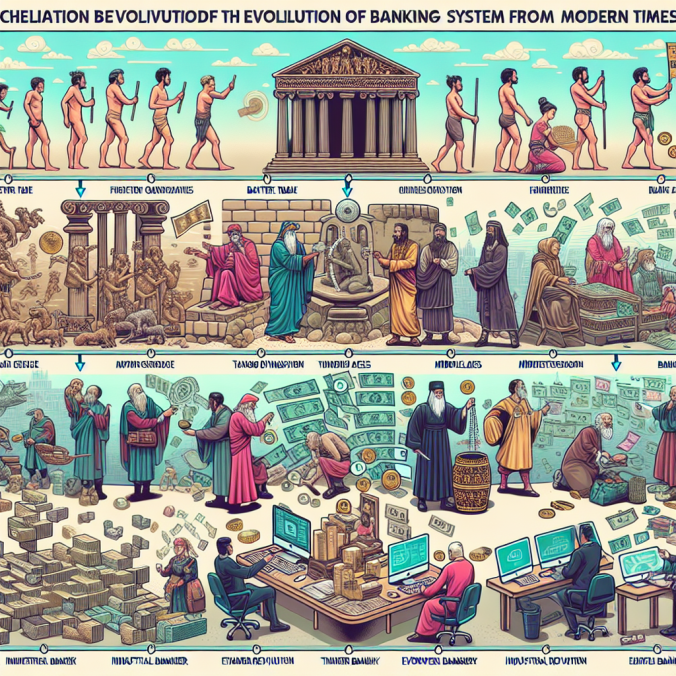

The History of Banking: From Barter to Modern Monetary Systems

Welcome to our journey down the financial rabbit hole! Today, we’re diving into the fascinating tale of banking – a saga filled with gold, intrigue, and, yes, a few modern clicks. So, grab your time travel gear as we explore how banking evolved from simple barter systems to the complex web of modern monetary institutions we rely on today.

The Barter System: Trading Cows for Chickens

In the beginning, life was simple, if not slightly chaotic. In ancient times, people maintained livelihoods through the barter system. This system involved a straightforward trade: goats for grains, cows for chickens, and occasionally, perhaps, a particularly stellar loaf of bread for a jug of fine mead.

While charmingly straightforward, bartering posed specific challenges:

- Difficulty in matching wants: Finding someone who wanted what you had and had what you wanted.

- Lack of standard value: How many chickens for one cow?

- Perishability: Goods like food couldn’t be stored indefinitely.

The Birth of Money: Enter the Ancient Coins

Eventually, humans, being the clever beings we are, devised a more efficient system. Enter money—a form of currency that allowed easier trading. Some of the earliest coins can be traced back to the Lydians around 600 BC. These coins were standardized and made from precious metals, which made them both valuable and relatively durable.

But the coins opened a whole new world where one didn’t have to trek a full day’s journey with livestock in tow. Money became:

- A medium of exchange

- A unit of account

- A store of value

The First Banks: Ancient Temples and Lending in Babylon

With the introduction of money, the concept of banking wasn’t far behind. Ancient temples in civilizations like Mesopotamia, Egypt, and Greece unofficially took the roles of the first banks, safeguarding people’s valuables, primarily gold and other precious items.

However, the real star in early banking was ancient Babylon. Around 2000 BC, Babylonians developed a rudimentary banking system where grains and other goods were deposited. This system eventually evolved to include lending and issuing some of the first known promissory notes. Talk about visionary!

Medieval and Renaissance Banking: Of Knights, Merchants, and Medici

Fast forward to the Middle Ages and Renaissance, and we see the rise of more sophisticated banking activities, primarily in Italy and other parts of Europe. The Roman Empire’s collapse had halted banking progress for a while, but around the 12th century, Italian city-states like Venice, Genoa, and Florence began to see a revival.

These days brought incredible characters and families like the Medici, who were essentially the rock stars of Renaissance banking. Their banking operations pioneered double-entry bookkeeping and financed significant artistic endeavors, contributing to an era fondly remembered for both wealth and culture.

The Industrial Revolution and Modern Banking

The Industrial Revolution transformed more than just production lines. From the late 18th to the 19th century, the explosion of trade and commerce necessitated more formal banking institutions. Enter the age of the bank we recognize today: centralized, regulated, and more crucial to an individual’s financial life than ever before.

Key developments during this era included:

- The establishment of central banks, starting with the Bank of England in 1694, to manage national economies.

- The introduction of paper money, which effectively replaced coins for everyday use.

- The proliferation of commercial banks to cater to the growing middle class and burgeoning businesses.

The Digital Revolution: Online and Mobile Banking

Banking saw another evolutionary leap as we stepped into the digital age. The late 20th and early 21st centuries have witnessed unprecedented changes. With the advent of computers and the Internet, online banking emerged, allowing people to manage their finances without stepping foot in a physical bank.

Fast-forward to today, where mobile banking and fintech apps like PayPal, Venmo, and others have revolutionized how we deal with money. Cryptocurrencies like Bitcoin have even added a new dimension to banking, emphasizing decentralization and digital security.

For a deep dive into how this transformation took place, check out this [YouTube Video on the History of Banking](https://www.youtube.com/watch?v=your-link-here).

The Future of Banking: What Lies Ahead?

As we look to the future, banking will likely continue to evolve with technological advancements. Think blockchain, artificial intelligence, and contactless payment systems. The possibilities are endless, and only time will tell what new chapters will be added to the rich history of banking.

So there you have it—a quick, yet comprehensive, journey through the history of banking. From bartering livestock to clicking for crypto, our methods of storing, exchanging, and managing value have come a long way. The path has been winding, occasionally rocky, but always fascinating, much like history itself.

Stay tuned for more exciting explorations into the worlds of finance, history, and technology right here on our blog!